Getting a home, remortgaging, or purchasing residential or commercial property can be one of the most essential financial decisions you'll ever make. That's why having actually a relied on specialist on your side is critical. Whether you're a new customer, relocating home, seeking to remortgage, or thinking about buy-to-let chances, a regional Mortgage Broker Merseyside can help guide you through every action of the procedure.

In this message, we'll break down the value of using a mortgage broker, clarify just how the process works, and emphasize why selecting a Mortgage Broker Liverpool, Mortgage Broker Crosby, Mortgage Broker Ormskirk, Mortgage Broker Preston, Mortgage Broker Southport, or Mortgage Broker West Lancs could make all the difference in your economic journey.

Why Use a Mortgage Broker?

A mortgage broker works as an intermediary between you and possible loan providers. Rather than going straight to a financial institution or building society, a broker searches across numerous loan providers to find the most effective offer customized to your requirements. This saves you time, possibly saves you cash, and ensures you obtain professional advice throughout the procedure.

Some key advantages of using a local broker:

Accessibility to exclusive bargains not available to the general public

Expert expertise of the Merseyside and North West home markets

Assistance with documents and application procedures

Advice customized to your economic circumstance and objectives

Assistance with remortgaging, buy-to-let, and a lot more

Whether you're in the heart of Liverpool or the quieter locations of West Lancashire, a regional broker can supply unmatched understanding and personal service.

Mortgage Broker Liverpool-- City-Centric Expertise

The Liverpool housing market is just one of the most dynamic in the UK. From modern-day apartments by the waterside to historical terraced homes, the city supplies something for every kind of customer.

A Mortgage Broker Liverpool recognizes the fast-paced nature of the city's housing demand. They can aid new buyers find budget friendly starter homes, advise financiers on rental hotspots, and help households updating to bigger homes. Their experience with neighborhood lending institutions, property values, and legal considerations is a substantial advantage when navigating the market.

For those thinking about Liverpool remortgages, a broker can examine whether changing loan providers or renegotiating your present offer might save you money.

Mortgage Broker Ormskirk-- Suburban Insight

Just 13 miles north of Liverpool, Ormskirk is a picturesque market community supplying a quieter way of living with superb transportation web links. A Mortgage Broker Ormskirk understands the regional nuances of buying in a smaller sized, dense neighborhood and can provide targeted guidance on suitable mortgage items for country or rural homes.

Whether you're purchasing a period home near the community centre or a new-build on the edge of town, an Ormskirk-based broker can help you safeguard affordable rates with flexible terms.

Mortgage Broker Crosby-- Coastal Confidence

The seaside community of Crosby is understood for its stunning coast, exceptional institutions, and close proximity to Liverpool. Whether you're transferring for work, updating your home, or purchasing a family-friendly neighbourhood, a Mortgage Broker Crosby supplies regional knowledge that's tough to beat.

With climbing rate of interest in coastal buildings and buy-to-let chances near tourist destinations, a Crosby broker can help you make a monetarily sound choice that meets your lasting goals.

Mortgage Broker Preston-- Strategic North West Knowledge

Heading inland, Preston uses an appealing mix of price, location, and development potential. With advancements in both residential and industrial fields, the city is progressively attracting interest from financiers and homeowners alike.

A Mortgage Broker Preston can assist you browse the broad financing alternatives available while capitalizing on local chances and motivations. Whether you're buying your very first home, including in your investment portfolio, or thinking about a Preston remortgage, a neighborhood broker can make the procedure smoother and more successful.

Mortgage Broker Southport-- Classic Elegance and Investment Potential

Understood for its Victorian style, elegant promenades, and strong tourism market, Southport is a prime area for both residential and investment homes. A Liverpoool remortgages Mortgage Broker Southport comprehends the equilibrium in between timeless homes and modern-day amenities, as well as the seasonal nuances of the residential or commercial property market.

With deep roots in the area, Southport brokers can encourage on whatever from vacation let home loans to buy-to-let, shared ownership schemes, and novice buyer support.

Mortgage Broker West Lancs-- Regional Reach and Rural Property Guidance

The Mortgage Broker West Lancs network covers a diverse range of communities and towns in West Lancashire. Whether you're acquiring a farmhouse in the countryside or a condominium in Skelmersdale, regional brokers comprehend the regional home landscape and loaning demands.

They provide hands-on support for one-of-a-kind properties, farming land acquisitions, and custom-made mortgage needs that nationwide firms might not totally recognize.

Liverpool Remortgages-- When and Why to Reevaluate Your Mortgage

If you're already a property owner in Liverpool or Merseyside, now could be the time to consider Liverpool remortgages. With rates of interest changing and home values transforming, a remortgage might help you:

Lower your regular monthly payments

Switch over from a variable to a fixed-rate offer

Borrow extra funds for home improvements

Settle financial obligations into a solitary repayment

Launch equity for personal objectives or investments

A relied on mortgage broker can analyze your present home mortgage and supply alternatives tailored to your demands-- commonly finding offers you wouldn't discover by yourself.

What to Expect When Working with a Mortgage Broker

Choosing the appropriate Mortgage Broker Merseyside or in surrounding locations is key to getting a personal, efficient, and easy mortgage experience. Right here's what you can anticipate:

Initial Consultation

You'll discuss your objectives, budget, earnings, and building details.

Home loan Search

The broker will certainly search through dozens (or hundreds) of home loan items to find suitable choices.

Application Support

They'll take care of paperwork, liaise with loan providers, and overview you via approval.

Ongoing Communication

Throughout the process, your broker will certainly maintain you educated, answer questions, and make certain you're comfy every action of the means.

Post-Mortgage Advice

Also after your mortgage is approved, numerous brokers provide yearly evaluations to guarantee you're still on the most effective bargain.

Last Thoughts: Trust a Local Mortgage Broker in Merseyside

Whether you're acquiring your first home in Liverpool, upgrading in Southport, or remortgaging in West Lancs, having a well-informed home loan consultant on your side is vital. A relied on Mortgage Broker Merseyside supplies not simply access to lots-- however comfort.

With many areas covered-- from Mortgage Broker Liverpool to Mortgage Broker Crosby, Ormskirk, Preston, and beyond-- you're sure to find an expert that recognizes your demands and is devoted to assisting you accomplish your monetary and homeownership goals.

Martland Mortgages.com Ltd

Westminster Chambers, 106 Lord St, Southport PR8 1LF, United Kingdom

170-480-8286

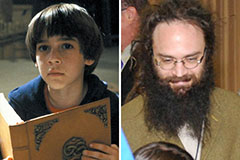

Barret Oliver Then & Now!

Barret Oliver Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now!